24 June 2024: In the complex world of global trade regulations, a new law can send shockwaves, causing businesses to scramble to adjust. The EU's proposed European Union Deforestation Regulation (EUDR), set to go into effect on December 30, 2024, is poised to send ripples throughout the forest products industry.

With the forest products industry at the center of the stage and many concerned about their ability to meet compliance, it is important to assess how the EUDR might reshape the industry and how companies can prepare, adapt, and even thrive in its wake.

Understanding the EUDR and Its Potential

Ratified over the summer of 2023, the EUDR aims to prevent and mitigate the impact of deforestation and forest degradation associated with certain commodities placed on the EU market. This initiative will require all forest product companies exporting to the EU (called "Operators" in the regulation) to provide certain facts to EU authorities, proving that the good's production did not contribute to the deforestation of primary forests. To accomplish this, the law requires that operators provide:

- A due diligence statement attesting to compliance with the law

- Geo-location data for every harvest tract that produced the wood or wood fiber in the product

Companies that are not compliant will be prohibited from selling into the EU and fined at least 4% of total revenue earned from sales to Europe in the previous year.

The law, however, is not without its critics and complexities. Forestry professionals, companies, and associations have expressed concerns over the law's scope, the feasibility of compliance, and whether it could provoke trade disputes with other nations. Nevertheless, the likelihood of its implementation demands the attention of those involved in producing and trading forest products.

Charting Impact and Identifying Viable Routes

The forest products industry produces a broad array of end products, and the impact of the EUDR will vary. Certain segments will be more affected than others. For example, the EUDR will likely advantage pulp and paper producers who own and operate their own tree plantations for pulp fiber over those that source wood fiber from complex supply chains that include forest thinnings, sawmill residual chips and sawdust, and harvest residues (tops, branches, etc.).

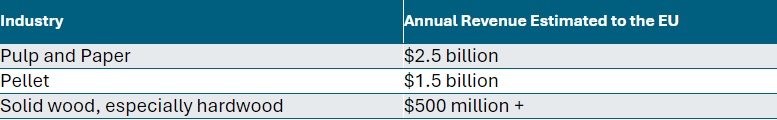

The pulp, paper, pellet, and solid wood industries collectively contribute billions of dollars annually to the EU economy. Non-compliance with EUDR could jeopardize significant portions of these revenues. Such changes would significantly impact not only individual companies but also broader economic landscapes.

The chart below shows an estimated manufacturing trade value at risk from EUDR non-compliance.

Traders and producers in certain countries, particularly those with a higher incidence of deforestation or weaker forestry management practices, may find themselves at a disadvantage. The realignment of trade flows and possible pressure on pricing and margins are also possible outcomes that companies must anticipate and strategize around.

Concerns with the EUDR

The EUDR is not a standalone measure; it's part of a broader agenda toward a greener economy. This bigger picture implies that companies that align with the EU's sustainability objectives stand to gain more than mere compliance.

Nevertheless, there is a growing concern among companies and organizations regarding the practicality of meeting these regulatory requirements. Many are advocating for potential amendments to the legislation or an extension of the enforcement date to address these challenges.

For example, Austria's forestry minister is demanding that EU states with no deforestation risk be exempt from the regulation. The US Senate has also spoken up, urging the US Trade Representative (USTR) to engage with the European Commission on the challenges of the EUDR. In its current form, the regulation "poses significant concerns for our country."

Navigating the complex web of EUDR requirements and market shifts requires a proactive stance. Despite the challenges and uncertainties, companies must proactively devise a compliance strategy ahead of the EUDR's enforcement.